Not known Facts About Hsmb Advisory Llc

Not known Facts About Hsmb Advisory Llc

Blog Article

The smart Trick of Hsmb Advisory Llc That Nobody is Talking About

Table of ContentsThe smart Trick of Hsmb Advisory Llc That Nobody is Talking AboutSome Known Details About Hsmb Advisory Llc Some Known Details About Hsmb Advisory Llc The Best Guide To Hsmb Advisory LlcFacts About Hsmb Advisory Llc RevealedFascination About Hsmb Advisory Llc

Ford says to avoid "cash worth or long-term" life insurance policy, which is more of a financial investment than an insurance policy. "Those are very complicated, included high payments, and 9 out of 10 individuals don't need them. They're oversold due to the fact that insurance policy representatives make the biggest payments on these," he states.

Disability insurance policy can be pricey. And for those who choose for lasting care insurance policy, this policy may make impairment insurance coverage unneeded.

Some Ideas on Hsmb Advisory Llc You Need To Know

If you have a chronic health problem, this sort of insurance can finish up being critical (Insurance Advisors). Do not allow it stress you or your bank account early in lifeit's typically best to take out a policy in your 50s or 60s with the expectancy that you won't be utilizing it until your 70s or later on.

If you're a small-business owner, take into consideration safeguarding your livelihood by purchasing company insurance coverage. In case of a disaster-related closure or duration of restoring, business insurance can cover your income loss. Take into consideration if a considerable weather event impacted your store or manufacturing facilityhow would that affect your revenue? And for exactly how long? According to a report by FEMA, in between 4060% of small services never reopen their doors adhering to a calamity.

Plus, using insurance coverage can occasionally set you back even more than it saves in the long run. If you get a chip in your windshield, you might consider covering the repair service expense with your emergency savings instead of your automobile insurance. Life Insurance St Petersburg, FL.

How Hsmb Advisory Llc can Save You Time, Stress, and Money.

Share these tips to safeguard loved ones from being both underinsured and overinsuredand speak with a relied on expert when needed. (https://www.taringa.net/hsmbadvisory/health-insurance-st-petersburg-fl-your-ultimate-guide_5bpkou)

Insurance coverage that is acquired by a specific for single-person insurance coverage or protection of a family members. The specific pays the premium, as opposed to employer-based medical insurance where the employer frequently pays a share of the premium. Individuals might go shopping for and acquisition insurance policy from any strategies available in the individual's geographic area.

Individuals and family members may qualify for financial aid to reduce the price of insurance policy costs and out-of-pocket expenses, but just when signing up through Connect for Wellness Colorado. If you experience particular modifications in your life,, you are eligible for a 60-day duration of time where you can enroll in a private plan, also if it is outside of the yearly open enrollment duration of Nov.

15.

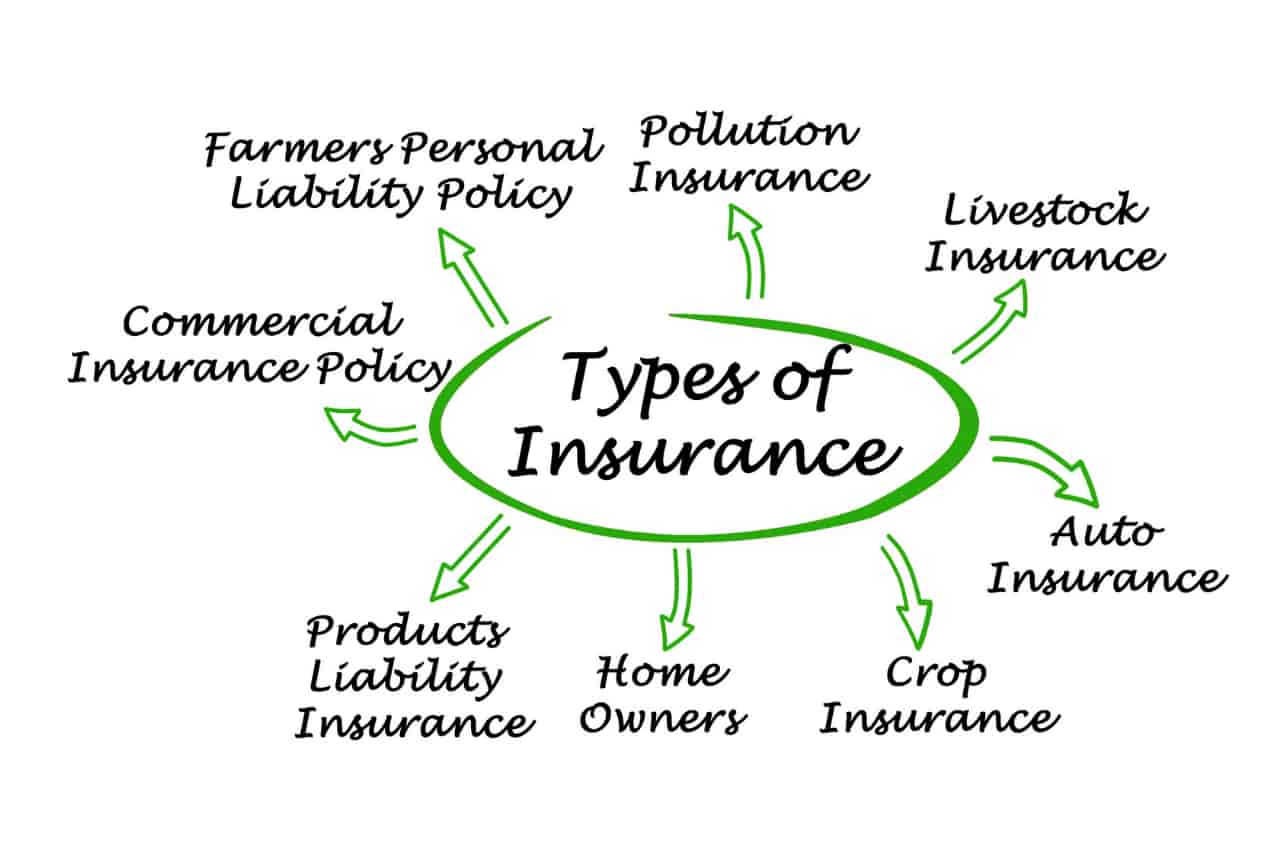

It may appear easy yet understanding insurance policy types can additionally be perplexing. Much of this confusion originates from the insurance policy market's recurring objective to create individualized insurance coverage for policyholders. In developing flexible policies, there are a selection to choose fromand every one of those insurance coverage kinds can make it challenging to understand what a particular plan is and does.

7 Simple Techniques For Hsmb Advisory Llc

If you die throughout this duration, the person or her latest blog individuals you've called as recipients might get the money payout of the plan.

However, lots of term life insurance coverage policies let you transform them to an entire life insurance policy plan, so you do not shed protection. Normally, term life insurance policy plan premium payments (what you pay monthly or year right into your policy) are not locked in at the time of acquisition, so every five or 10 years you possess the plan, your premiums can increase.

They also tend to be cheaper total than whole life, unless you get a whole life insurance coverage policy when you're young. There are also a couple of variations on term life insurance policy. One, called group term life insurance policy, prevails among insurance choices you may have access to via your employer.

The Only Guide for Hsmb Advisory Llc

This is usually done at no charge to the staff member, with the capacity to purchase extra insurance coverage that's gotten of the worker's paycheck. An additional variant that you might have access to through your employer is additional life insurance coverage (Insurance Advise). Supplemental life insurance policy can consist of unintended death and dismemberment (AD&D) insurance policy, or interment insuranceadditional coverage that can aid your household in instance something unexpected happens to you.

Irreversible life insurance policy simply refers to any type of life insurance coverage plan that does not run out. There are numerous types of irreversible life insurancethe most usual types being whole life insurance policy and universal life insurance policy. Whole life insurance policy is specifically what it sounds like: life insurance coverage for your whole life that pays to your beneficiaries when you pass away.

Report this page